EIIS as a Tax-Efficient Cash Extraction Method for Business Owners

When you’re a business owner, cash flow and tax efficiency go hand-in-hand. One of the most challenging aspects of owning a business is figuring out how to withdraw cash from your company without facing a mountain of taxes. While most business owners know the Employment and Investment Incentive Scheme (EIIS) as a tool to fund SMEs, few realise it can also be a clever method for cash extraction. This blog dives into how EIIS can be a valuable strategy for company owners seeking tax relief when withdrawing cash from their businesses.

What is the EIIS?

The Employment and Investment Incentive Scheme (EIIS) is a government-backed initiative designed to promote investment in small and medium-sized enterprises (SMEs) in Ireland. By investing in EIIS-eligible companies, individuals can claim significant tax relief on their investments, making it an appealing option for passive investors. However, EIIS can also serve as a tax-efficient cash extraction method for business owners.

Why Cash Extraction is Tricky for Company Owners

Most business owners know that extracting profits from their company, whether through salary or dividends, can be painfully costly due to high tax rates. For example, if a company director wants to withdraw €100,000 in cash, they could face:

Income Tax: 40%

Universal Social Charge (USC): 8%

Pay Related Social Insurance (PRSI): 4%

In total, this adds up to a 52% tax hit, leaving the director with only €48,000 net.

How EIIS Can Help with Cash Extraction

Now, here’s where EIIS comes in as a powerful alternative. Through EIIS, business owners can get up to 50% tax relief, potentially saving tens of thousands of euros in personal taxes. Let’s break down how this would work with a practical example of a €500,000 dividend withdrawal:

Step 1: Declare the Dividend

You declare a €500,000 dividend from your company. The first tax implication is Withholding Tax (WHT), which applies at a rate of 25%. This means €125,000 is withheld, leaving a net dividend of €375,000.

Step 2: Calculate Total Tax Liability

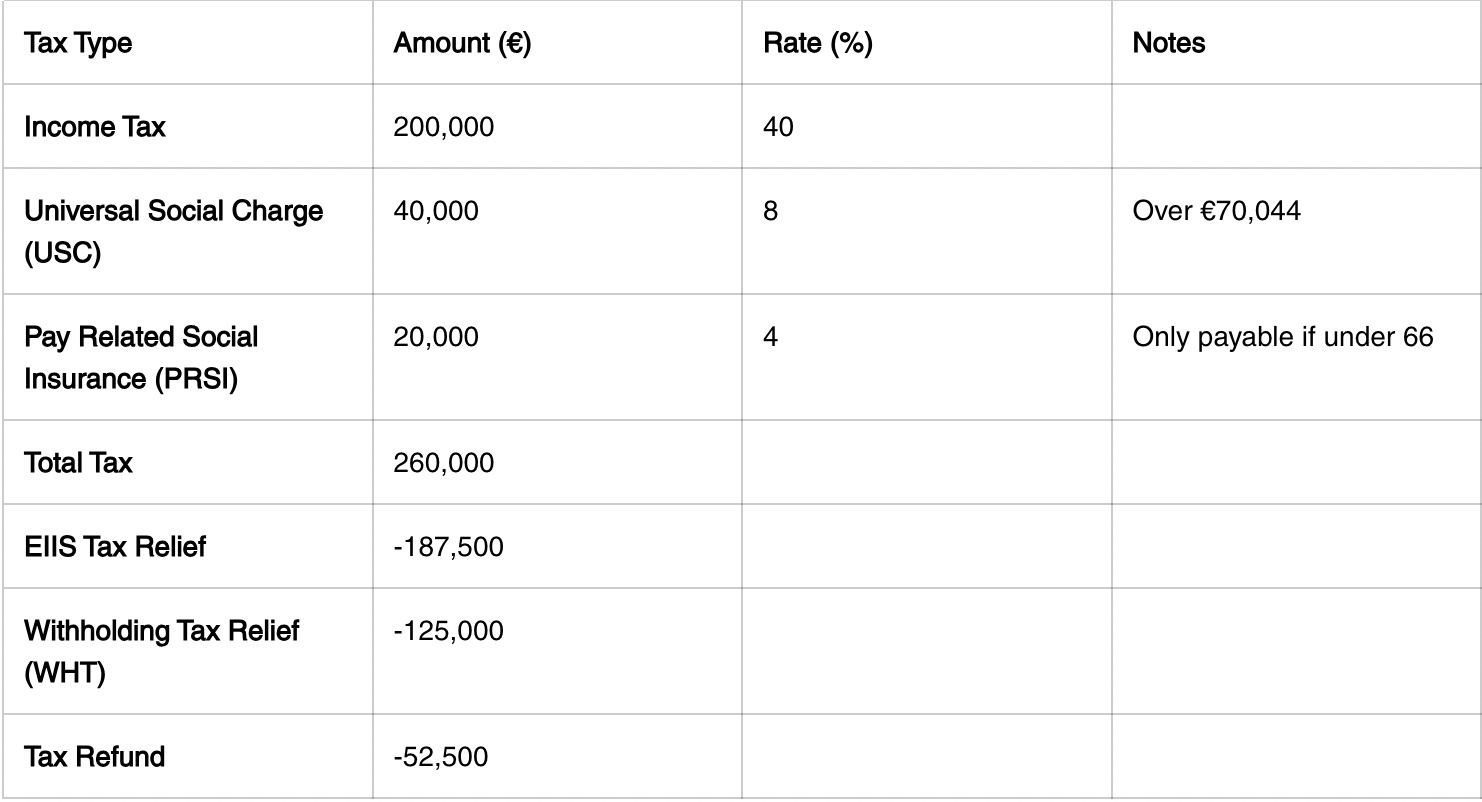

Once the dividend is withdrawn, additional personal taxes apply:

Income Tax: 40%, or €200,000.

USC: 8%, or €40,000.

PRSI: 4%, or €20,000.

This results in a total tax liability of €260,000, leaving you with far less than anticipated.

Step 3: Offset with EIIS Investment

Now, suppose you invest €375,000 in an EIIS-eligible company. With EIIS, you’re eligible for up to 50% tax relief, meaning you could offset €187,500 of your income tax liability. This translates into a €187,500 reduction in their tax liability, bringing the tax bill down from €260,000 to €72,500. As €125,000 has already been paid in WHT, you will receive a refund of €52,500 (€125,000 paid - €72,500 actual tax due).

Total Tax Liability: €260,000

Initial Dividend Withheld (WHT): €125,000

EIIS Tax Relief: -€187,500

Tax Refund After EIIS: +€52,500

EIIS Investment Return: Worked Example

If the Company Owner invests with EIIS, the investor would receive €502,500 over four years, significantly increasing their after-tax returns compared to withdrawing the dividend without EIIS involvement, i.e. €240,000. This is a significant benefit of €262,500.

See breakdown below:

Holding Company

Total Tax Breakdown

EIIS Investment

Cashflow

By strategically utilising EIIS, the company owner manages to extract a total after-tax cashflow of €502,500 over four years, extensively better than taking a straight dividend without EIIS, which would have left only €240,000. As you can see, the benefit of €262,500 is quite significant.

Please note that the above scenario ignores the fact that a company tax deduction could improve the tax outcome for the investor if the company is trading entity and a bonus used in exchange for a dividend.

Benefits of Using EIIS for Cash Extraction

Using EIIS for cash extraction provides several benefits for business owners:

Higher Net Returns: By reducing your tax bill, EIIS increases the amount of cash you can retain in your pocket.

Flexible Investment Opportunity: With EIIS, you’re not just saving on taxes; you’re also investing in eligible companies that can yield returns over time.

Access to Tax Credits: EIIS tax relief applies immediately, so you don’t have to wait for years to see the financial benefits.

Future Financial Security: EIIS investments can contribute to a diversified portfolio, adding to your wealth in a tax-efficient way.

Important Considerations

While EIIS offers substantial tax advantages, it’s not a one-size-fits-all solution. Here are some things to keep in mind:

Complex Tax Situations: The tax benefits from EIIS can vary depending on your corporate structure and personal financial situation. Consulting a tax advisor is essential to determine the best approach.

Investment Risk: Like any investment, EIIS carries risks. Make sure the EIIS-eligible company you’re investing in aligns with your risk tolerance and financial goals.

Timing and Liquidity: EIIS funds often have a minimum holding period, which means you won’t have immediate access to your money. Ensure you’re comfortable with the timeline before committing.

Upcoming EIIS Investment Opportunity

For those interested, the EIIS Innovation Fund 2024 opens for investment on November 1st and closes on December 31st 2024. This fund is an excellent option for passive investors, offering professional management and diversified exposure to EIIS-eligible companies. If you’d like to explore how EIIS can work for you, reach out to us at info@quintascapital.ie